For several business people, the Employee Retention Tax credit score (normally referred to as the ERC or ERTC) delivers critical economical aid following the difficulties with the earlier number of years. companies which are Profiting from this important tax gain are likely nervous to stay informed as towards the standing of their ERC claims and accurately anticipate when they could obtain their ERC resources. So, how can a company Check out the standing of its ERC declare?

very first, it’s vital that you understand that ERTC processing will take time, and there might be delays as a result of superior volume of statements becoming submitted. Furthermore, the IRS may perhaps ask for further documentation or information and facts from you ahead of approving your assert, that may even further delay your refund. It’s common for the whole ERTC process to consider many months, so you'll want to set acceptable anticipations concerning the timeline when you’re submitting for your ERC.

if you need to Look at about the standing of an ERC claim, your starting point should be to connect with the IRS at its toll-cost-free amount, one-800-829-1040. be sure you have your EIN and almost every other related facts related to your assert Completely ready whenever you simply call – and become geared up for an extended wait around. read more (it's possible you'll practical experience a shorter wait time for those who contact early each morning.)

When you have on the net entry to your IRS account, it is possible to try out examining your on the net account to determine if you can find any updates or alterations observed there. in the event you don’t have online IRS access set up however, you may make an IRS account below (you will need to have photo identification readily available).

in the event you’re obtaining difficulty having the data you will need through the IRS, you'll be able to always consult an ERC expert for support together with your ERC filing. a qualified Employee Retention Tax credit rating guide may be able to help you establish the status of one's ERC submitting, or maybe assist you declare the ERC For added quarters if suitable.

that can help mitigate this uncertainty and prevent potential delays, some organization–entrepreneurs decide to submit an application for an ERTC progress mortgage, which can offer access to ERC resources on credit when expecting the IRS to method the claim. These financial loans is usually acquired through a variety of lenders, and eligibility requirements and phrases may well differ depending upon the lender, the dimensions of your small business, and various variables.

In conclusion, the best way to check the standing of one's ERTC claim is by specifically calling the IRS around the cellular phone, but you could also test examining your IRS account online or consider consulting using an ERC Qualified for help. though the process is often prolonged, taking proactive actions to monitor your assert position – together with looking at possibilities like ERTC financial loans (ertcfunding.com) – will help deliver crucial aid for your company as it financially recovers from your COVID-19 pandemic.

Romeo Miller Then & Now!

Romeo Miller Then & Now! Keshia Knight Pulliam Then & Now!

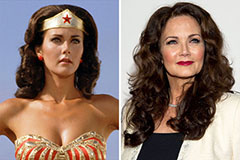

Keshia Knight Pulliam Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!